Discover the Value of Private Health Plans

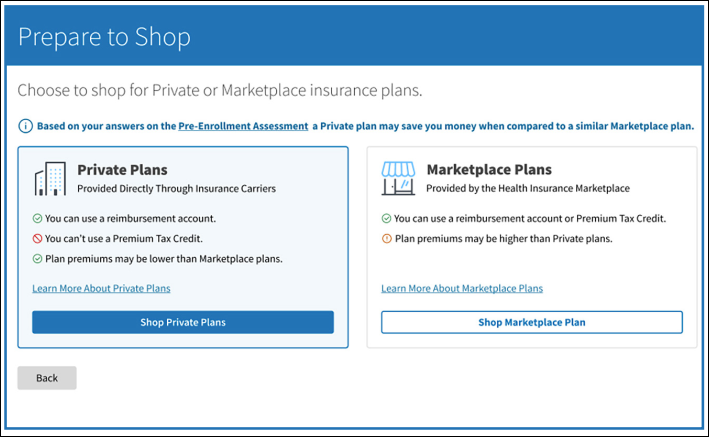

Via Benefits now offers a new class of individual and family health plans for Pre-Medicare retirees that deliver excellent value at a lower cost: Private plans.

These plans are provided directly by insurance carriers and meet Via Benefits’ quality standards. While they don’t appear on the federal Health Insurance Marketplace—hence the term “private”—they can offer comparable or even better coverage than Marketplace plans, often at a reduced cost.

Private plans offer the same consumer protections as Marketplace plans, such as guaranteed issue, enrollment period rules, and no medical underwriting.

It’s important to note that these plans are not eligible for federal subsidies—but if you are eligible and have opted into employer funding (often called a Health Reimbursement Arrangement or HRA), this shouldn’t be a concern.

Why consider a Private plan?

If you’re not eligible to use a Premium Tax Credit or Cost-Sharing Reduction, a Private plan could be a smart choice. These plans are not available everywhere, but they are in Ohio, Michigan, and several other states.

Who should explore Private plans?

Current Silver Plan enrollees: If you’re enrolled in a Silver Marketplace plan, consider reviewing Private plan options during your enrollment period.

Bronze or Gold Plan enrollees: If you’re in a Bronze plan and want more coverage, or in a Gold plan and could use less, a Private Silver Plan might strike the right balance.

Explore Private Plans

To explore your options:

Visit the Via Benefits website during your enrollment period.

Sign in and select Shop & Compare.

Answer a few health-related questions.

If Private plans are available in your area, you’ll see an option to view them. Follow the prompts to explore your choices.

Note: If you live in a state where Private plans are not offered, or if you’ve chosen to receive a federal subsidy, you won’t see this option.

Need help?

If you have questions or need assistance choosing the right plan, contact a licensed benefit advisor at Via Benefits. We’re ready to help you make the right decision for your needs.